With a poor credit history, people may encounter difficulties securing loans, obtaining credit cards, renting apartments, or getting approved for certain jobs. However, amid these challenges, bad credit loan guaranteed approval sites are a lucrative alternative.

These lenders provide loans to people with less-than-perfect credit scores, including those who traditional lenders may have turned away.

Yet, with many fast loans for bad credit sites available, finding a trustworthy and reliable option can be daunting. To address this challenge, our team of experts has meticulously tested and analyzed over 100 bad credit sites to identify the top contenders.

They have curated a list of the 4 Best Bad Credit Loans Guaranteed Approval in 2024. So, read on to discover the best solutions for your financial challenges.

How To Get Bad Credit Loans Guaranteed Approval

Securing a loan with bad credit can be challenging, but it’s not impossible. With the right approach, you can increase your chances of getting bad credit loans with guaranteed approval in 2024.

Check Your Credit Score

Start by getting a free copy of your credit report to understand your current credit situation. Identifying areas for improvement is crucial for strategizing your loan application process and maximizing your chances of approval.

Ensure Feasible Monthly Payments

Before committing to a loan, carefully assess your budget to ensure manageable monthly payments. Avoiding overextension is essential for maintaining financial stability and successfully repaying the loan.

Compare Loan Terms

Take the time to explore various loan offers from different lenders. Comparing terms such as repayment schedules and interest rates allows you to find the most favorable option that aligns with your financial goals.

Gather Financial Documents

Prepare all necessary financial documents in advance to streamline the loan application process. This includes gathering social security documents, identification, and tax returns, ensuring a smooth application experience.

Explore Lenders Without Credit Checks

Consider lenders who don’t require a credit check for loan approval, especially if you have a poor credit score. Exploring these options can broaden your opportunities for securing financing while minimizing the impact on your credit profile.

Build a Positive Payment History

Demonstrate your ability to manage credit responsibly by building a positive payment history. Making timely payments on existing debts can improve your credit score over time, making you a more attractive candidate for future loans.

Consider a Co-Signer

If you need help to secure a loan on your own due to bad credit, consider enlisting the help of a co-signer with good credit. A co-signer agrees to take on responsibility for the loan if you default, providing added assurance to the lender and increasing your chances of approval.

Monitor Your Credit Score Regularly

Keep track of your credit score regularly to monitor your progress and identify areas for improvement. Monitoring your credit allows you to detect any errors or discrepancies early on and take steps to address them.

Top 4 Bad Credit Loans Guaranteed Approval In 2024

Our team of experts has diligently researched and analyzed numerous high-risk loan guaranteed approval options to identify the top contenders in this space.

Here are the top 4 high-risk loan guaranteed approval options that our team recommends based on their competitive interest rates, flexible repayment terms, and positive customer reviews.

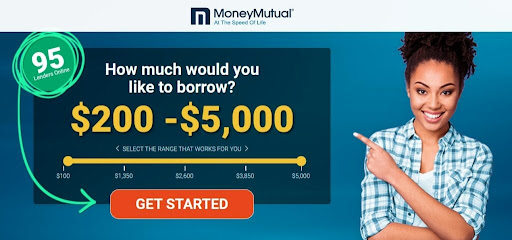

Overall Best Bad Credit Loans For Guaranteed approval, #1 Pick

24-hour payment guaranteed

No

Credit Score Required

$200 - $5,000

Loan Amount

Trusted Site For Personal Loans For Bad Credit Guaranteed Approval

Safe & Secure Platform For Poor Credit Loans

Fast Funding Of Emergency Loan Bad Credit Guaranteed Approval

#1. MoneyMutual– Overall Best Bad Credit Loans Guaranteed Approval, #1 Pick

Why Choose the Best Credit Loans in 2024?

Like Money Mutual, Bad Credit Loans is a no-credit-check guaranteed lender site that ranks #2 on our list. It offers fast and easy loan access for individuals with poor credit scores. Although the site doesn’t mention the minimum credit score required for approval, which makes it difficult to determine eligibility beforehand, this is a drawback.

However, borrowers can access funds ranging from $500 to $10,000, with repayment terms varying from three to 36 months. The APR ranges between 5.99% and 35.99%, but it may vary a few times based on the lender and the borrower’s creditworthiness.

Furthermore, what makes Bad Credit Loans stand out is that if it fails to find a lender in its network of lenders, it will show your loan inquiry to its extended network of third-party non-lender lender networks to help find you a lender in one of their networks.

Pros

- Protects your data with advanced encryption

- Offers 7+ different types of loans

- Keep you informed about recent scams

- You can request up to $10,000

- Rapid approval within 24-48 hours

Cons

- It doesn’t mention any minimum credit score

How do you apply for Bad Credit Loans Guaranteed Approval at Money Mutual?

Step 1: Provide Your Information

First, you just need to share basic information about yourself using a form. This information is then sent to different lenders for them to look at. You can do this quickly and easily. The best part is that you don’t have to pay anything to complete the form.

Step 2: Lenders Review

Once you’ve provided your information, lenders will review it immediately and decide whether to work with you based on their rules. The lender might contact you to confirm your details and finalize the loan. They might call, email, or text you, so reply quickly to get your money faster.

Step 3: Get Your Money

If a lender offers you a loan and you agree to it, they can deposit it directly into your bank account in as little as 24 hours. You and the lender decide the fees and how you’ll repay the loan. If you have questions about the costs or terms, talk to the lender directly.

Eligibility Requirements for Bad Credit Loans Guaranteed Approval

- Being a U.S. citizen

- Being at least 18 years old

- Having a steady income of at least $800 per month

- Possessing an active checking account

#2. BadCreditLoans– Trusted Site For Personal Loans For Bad Credit Guaranteed Approval

Why Choose the Best Credit Loans in 2024?

Like Money Mutual, Bad Credit Loans is a no-credit-check guaranteed lender site that ranks #2 on our list. It offers fast and easy loan access for individuals with poor credit scores. Although the site doesn’t mention the minimum credit score required for approval, which makes it difficult to determine eligibility beforehand, this is a drawback.

However, borrowers can access funds ranging from $500 to $10,000, with repayment terms varying from three to 36 months. The APR ranges between 5.99% and 35.99%, but it may vary a few times based on the lender and the borrower’s creditworthiness.

Furthermore, what makes Bad Credit Loans stand out is that if it fails to find a lender in its network of lenders, it will show your loan inquiry to its extended network of third-party non-lender lender networks to help find you a lender in one of their networks.

Pros

- Protects your data with advanced encryption

- Offers 7+ different types of loans

- Keep you informed about recent scams

- You can request up to $10,000

- Rapid approval within 24-48 hours

Cons

- It doesn’t mention any minimum credit score

How Do You Apply for Bad Credit Loans with Guaranteed Approval?

Step 1: Convenient Online Form

Getting a loan is easy with the Bad Credit Loans online form. Just fill it out, and you can receive a loan offer from its network of lenders in minutes. If approved, the money can be sent directly to your bank account within at least one business day.

Step 2: Loan Request Process

Our loan request process connects you with a lender who can help meet your financial needs. Once connected, the lender verifies your information and reviews your loan request. Depending on your details, the lender may offer you a loan.

Step 3: Repayment

Once you accept a loan offer, you must e-sign the lender’s contract. Then, the loan funds will be deposited directly into your checking account. Payment is typically made in installments over time, as specified in your lender’s repayment schedule.

Eligibility Requirements for Bad Credit Loans Guaranteed Approval

- Be at least 18 years old.

- Provide proof of citizenship, such as a Social Security number or legal residency.

- Regular income from employment, self-employment, disability, or Social Security benefits.

- Have a checking account in your name.

- Provide work and home telephone numbers.

- Provide a valid email address.

#3. CashUSA– Safe & Secure Platform For Guaranteed Approval Loans

Why Choose CashUSA for Bad Credit Loans in 2024?

Securing the #3 spot, CashUSA is a proud member of the Online Lenders Alliance (OLA) and offers secure and bad credit emergency loans fast. With a network of trusted lenders, CashUSA provides fast funding options for those needing financial assistance.

You can rest assured about its security and safety since CashUSA is an online lending industry pioneer committed to protecting customer information and providing transparent terms and conditions. Their user-friendly platform makes it simple to apply for a loan and receive funds quickly.

However, one problem for some borrowers is that the starting lending amount may be higher than they need, potentially leading to borrowing more than necessary. If you need more than $10,000, CashUSA may not be the best option, as their maximum loan amount is $10,000.

Pros

- The starting lending amount is $500

- The APR is b/w 5.99% and 35.99%

- Safe and reliable loan process

- Receive loans within 48-72 hours

- Can repay loan b/w 90 days to 72 months

Cons

- The APR may vary depending on the lender

How do you apply for Bad Credit Loans Guaranteed Approval in CashUSA?

Step 1: Fill Out the Online Form

To get started, fill out a simple form on our website. This form asks for basic information and only takes a few minutes to complete. As long as you meet the basic requirements, you can submit your request for a personal loan.

Step 2: Convenient Disbursement and Repayment

If a lender offers you a loan, you can review the offer before accepting it. Once received, the funds can be deposited directly into your bank account in as little as two to three business days.

Repaying the loan is also easy—the lender can withdraw the money electronically from the same account they deposited it into.

Eligibility Requirements for Bad Credit Loans Guaranteed Approval

- Be employed for at least 90 days with a monthly net income of over $1,000.

- Be at least 18 years of age.

- Have U.S. citizenship or permanent U.S. residency.

- Be listed as the primary account holder of a valid checking account.

- Have both work and home contact phone numbers.

- Have a working email address.

#4. PersonalLoans– Fast Funding Of Bad Credit Personal Loans Guaranteed Approval

Why Choose Personal Loans for Personal Loans in 2024?

On the last spot, we’ve got personal loans, which provide quick cash loans for bad credit within 1-3 days, making them a convenient option for those needing immediate funds. However, the APR rates for personal loans tend to be higher than other loans, so carefully considering the total cost before borrowing is important.

For instance, the APR for a 2-year loan is 6.99%, whereas a 4-year loan may have an APR of 10.45%. So, it’s crucial to weigh the benefits of quick access to funds against the potential long-term costs associated with higher APR rates.

Additionally, this high-risk loan guaranteed approval site offers other loans besides bad credit, such as fast cash, debt consolidation, emergencies, home improvement, online loans, tax loans, and credit reports and credit scores. Overall, Personal Loans offers a fast and flexible form to help connect you to a lender and complete an application.

Pros

- The minimum lending amount is $250

- The maximum amount ends at $35,000

- Can repay loan b/w 3-72 months

- Personal Loans are completely free of charge

- Safe and secure with a positive customer experience

Cons

- High Annual Percentage Rates

How do you apply for Bad Credit Loans Guaranteed Approval in Personal Loans?

Step 1: Fill Out the Online Form

You must complete a simple form on our website to apply for a loan. This form asks how much money you want to borrow, your credit score, and why you need the loan. You’ll also need to provide personal, banking, and income details. Lenders use this information to decide whether to offer you a loan.

Step 2: Processing of the Loan

After reviewing your loan request, lenders will decide if they want to offer you a loan. If they do, they’ll ask you to complete an application on their website. If your application is approved, you’ll be shown a loan agreement with details like how much you need to repay and when.

Step 3: Receiving the Loan

If you agree to the loan agreement terms, the lender will send the funds directly to your bank account. The time it takes for the money to reach your account depends on when the loan is approved and the lender you’re working with. Typically, you’ll receive the funds within one to five business days.

Eligibility Requirements for Bad Credit Loans Guaranteed Approval in Personal Loans

- Must be 18 or older to be eligible for a personal loan.

- Must have a valid Social Security number

- Must be a legal U.S. citizen or permanent resident

- Have full-time employment, be self-employed, or receive regular disability or Social Security benefits.

- Must have a valid bank account

PROS

- User-friendly website

- Loans for all occasions

- Quick support

- Educational resources

- Useful packages

CONS

- High rates for bad credit

How Did We Make The List Of The Top 4 Bad Credit Loans Guaranteed Approval?

Curating a list of the top 4 bad credit loans with guaranteed approval involves carefully considering various factors to ensure that borrowers can access reliable and reputable lending options. Here’s how we compiled our list to help individuals navigate the challenging landscape of bad credit loans.

Extensive Research

We started by researching numerous lenders on the market, looking for those specifically catering to individuals with bad credit and offering guaranteed approval. This involved analyzing customer reviews and feedback to gauge each lender’s satisfaction and reliability.

Evaluation of Loan Terms

After identifying potential lenders, we carefully evaluated the terms and conditions of their loan offerings. This included examining interest rates, repayment terms, fees, and eligibility criteria to determine each loan option’s overall value and suitability.

Consideration of Customer Experience

Customer experience is paramount when selecting the top bad credit loans with guaranteed approval. We prioritized lenders that offer a user-friendly online application process, responsive customer support, and transparent communication throughout the loan approval and funding process.

Review of Lender Reputation

Lastly, we reviewed each lender’s reputation and track record to ensure reliability and trustworthiness. We considered factors such as accreditation, regulatory compliance, and any history of consumer complaints or legal actions to vet the lenders’ credibility on our list.

Transparency of Terms and Conditions

We prioritized lenders who were transparent about their terms and conditions, ensuring borrowers fully understood the details of their loan agreements. Clear and concise information regarding interest rates, repayment schedules, and applicable fees was crucial in our selection process.

Flexibility in Repayment Options

We looked for lenders that offered flexible repayment options to accommodate diverse financial situations. This included customizable repayment schedules, deferment or forbearance options in case of economic hardship, and the ability to make early repayments without penalties.

Accessibility and Availability

Lastly, we considered the accessibility and availability of the lenders’ services, including online application processes, customer support channels, and geographical reach. We preferred lenders with easy-to-use online platforms and responsive customer service.

Factors To Consider Before Choosing Lenders For Bad Credit Loans Guaranteed Approval

There are many loan providers and networks on the internet, but not all are genuine. If you choose a bad credit loan guaranteed approval provider, you must consider a few factors.

These factors will help you determine whether a lender is right for you.

If you have bad credit, it doesn’t mean you should settle for very high interest rates. You can still get better rates and terms if you research online loans. To choose the best bad credit loan provider, consider the following factors:

Eligibility Requirements

You must consider the eligibility criteria before applying for a bad credit loan. This will help you save time. Different lenders have different eligibility criteria that the borrower must go through before investing their time in a lending network.

For example, the lender might require a high, stable income from the borrower. Though most lenders require around $800 to $1000 in monthly income, some might need more.

Other requirements include the minimum credit score and maximum debt-to-income ratio, which the borrower must consider before applying.

Loan Amounts

The loan amounts offered by lending networks vary from lender to lender. If you need a considerable loan, you must find a lender ready to provide the exact amount.

For example, lenders may give a loan of up to $5000 to a borrower with bad credit. If you need a loan amount higher than that, consider another lender.

This post has picked loan providers that offer varying loan amounts. For example, lenders offer personal loans up to $5000, while others can provide up to $10,000. Thus, it is essential to consider the minimum and maximum loan amounts before choosing a lender.

Repayment Terms

Repayment terms mean the amount of time the lender requires from the borrower to repay the loan. Some lenders require a short repayment term, which means that the borrower has to pay back the loan in a short time. Repaying the loan is beneficial if you have a regular, steady income. Still, the interest rate is higher because the lender wants to collect more interest quickly from the borrower.

On the other hand, long repayment terms are used to finance major purchases. With a long repayment term, the monthly payments are small because the borrower repays the loan amount over a long time.

Interest Rate and Fees

Lenders use different criteria and methods to calculate the interest rates they offer borrowers. Therefore, it is essential to get quotes from various lenders and compare them to choose the one that provides the most reasonable interest rate and fees. The interest rate for people with bad credit is higher than that for those with good credit. Lenders charge high interest rates because there is a risk of default from the borrower’s side.

A bad credit borrower has missed or made late payments with their previous lenders. Chances are that these borrowers have already taken multiple loans that they have to pay. Thus, lenders consider them high-risk borrowers.

Customer Experience

It is crucial to read customer reviews before choosing a lending network. In this post, we have chosen lending networks with the majority of positive reviews, which shows that most customers are satisfied. Lending networks with the most negative reviews and unsatisfied customers indicate their performance is not up to par.

Even if these lenders don’t charge very high interest rates, other services might create trouble for the borrowers if they have negative reviews.

Type of Loans

Bad credit Borrowers have many choices when it comes to loans. There are personal loans, secured and unsecured loans, online loans, payday loans, and debt consolidation loans. A payday loan has a short repayment time, usually two weeks, during which the borrower has to repay the loan amount.

These loans are helpful for people looking for payday loans for bad credit, as they help them improve their credit quickly. A personal loan is a broad category comprising different types of loans individuals can use to meet their requirements.

How to Improve Your Bad Credit Score?

Improving your bad credit score is essential for better financial opportunities and lower interest rates. Here are some strategies to help you improve your bad credit score.

Check Your Credit Report

Start by obtaining a copy of your credit report from the major credit bureaus. Review the report carefully to identify any errors or inaccuracies that may negatively impact your credit score. Dispute any discrepancies and ensure that your credit report reflects accurate information.

Pay Bills on Time

Payment history is a major factor in determining your credit score. Paying your bills on time each month demonstrates responsible financial behavior to creditors and gradually rebuilds trustworthiness.

Reduce Credit Card Balances

High credit card balances can negatively impact your credit score, especially if your credit utilization ratio is high. Aim to keep your credit card balances low relative to your credit limits to improve your credit utilization ratio and boost your credit score.

Limit New Credit Applications

Applying for multiple new credit accounts quickly can raise red flags for lenders and negatively impact your credit score. Limit new credit applications to only those you need, and avoid opening unnecessary accounts.

Consider Credit-Builder Loans or Secured Credit Cards

You can opt for alternative

options such as credit-builder loans or secured credit cards. These products are designed to help individuals with bad credit establish or rebuild their credit history by making timely payments and demonstrating responsible credit use.

FAQs About Bad Credit Loans Guaranteed Approval

Q1. What are the easiest loans to get with bad credit?

Secured, co-signed, and joint loans are the easiest to approve with bad credit since you may use another person’s collateral or creditworthiness to compensate for your poor credit score. Although they are simple to obtain, payday, pawnshop, and auto title loans are also very expensive.

Q2. Where can I get a loan with a credit score of 500?

MoneyMutual and Badcreditloans offer the best personal loans for those with credit scores under $500. No credit check will be performed when you apply for a loan with one of these businesses, which specializes in lending to those with bad credit.

Q3. How fast can I secure a bad credit loan with guaranteed approval?

Bad credit loans with guaranteed approval are designed for quick access to funds. The exact time to secure a loan can vary depending on the lender and your circumstances. However, many lenders offer fast approval processes, with funds typically disbursed within a few business days of approval.

Q4. Are there any upfront fees for applying for bad credit loans with guaranteed approval?

Most reputable lenders of bad credit loans with guaranteed approval do not charge upfront fees for applying. Be sure to review the terms and conditions of any loan offer carefully to ensure transparency regarding charges.

Q5. Can bad credit loans with guaranteed approval improve my credit score?

While bad credit loans with guaranteed approval may not directly improve your credit score, timely repayments can demonstrate responsible financial behavior over time, positively impacting your creditworthiness.

Q6. How do I choose the best lender for bad credit loans with guaranteed approval?

When choosing a lender for bad credit loans with guaranteed approval, consider factors such as reputation, loan terms, customer service, and interest rates. Look for lenders like Money Mutual with a record of positive reviews and transparent lending practices, ensuring a positive borrowing experience.

Q7. What maximum loan amounts are available for bad credit loans with guaranteed approval?

Maximum loan amounts for bad credit loans with guaranteed approval vary depending on the lender and your financial circumstances. Some lenders may offer higher loan amounts than others, so it’s essential to compare options to find the best fit for your needs.

Q8. What interest rates should I expect for bad credit loans with guaranteed approval?

Interest rates for bad credit loans with guaranteed approval can vary depending on the lender, loan amount, and your creditworthiness. While interest rates may be higher for individuals with bad credit, shopping around and comparing offers can help you find competitive rates.

Q9. Are there any risks associated with bad credit loans with guaranteed approval?

Like any financial product, there are potential risks associated with bad credit loans with guaranteed approval. These may include higher interest rates, shorter repayment terms, and more. However, you can minimize these risks by borrowing responsibly and choosing a reputable lender.

Q10. Can I use bad credit loans with guaranteed approval for any purpose?

Yes, bad credit loans with guaranteed approval can typically be used for any purpose, such as debt consolidation, emergency expenses, home improvements, or unexpected bills. However, it’s essential to borrow only what you need and to use the funds responsibly to avoid further financial strain.

Conclusion: Which Loan Company Is Easiest To Get With Bad Credit?

Dealing with bad credit challenges can be overwhelming, but solutions are available to help individuals regain financial stability.

Bad credit loan guaranteed approval sites offer a promising avenue for those needing financial assistance. They provide access to much-needed funds when traditional lenders may turn them away.

Additionally, after careful evaluation, Money Mutual has emerged as the #1 choice, offering reliable service, favorable terms, and exceptional customer support. Whether you need funds to cover unexpected expenses, consolidate debt, or pursue personal goals, Money Mutual provides a reliable solution to meet your needs.

Don’t let bad credit hold you back! Take control of your financial future today and achieve your future goals. Sign up now!