Over the past decade, living costs have surged significantly, leading many individuals to rely on personal loans to cope with the rising inflation. However, due to the strenuous application processes, accessing motorcycle financing can be daunting.

While numerous bad credit motorcycle loan companies are available online, you can not trust all of them.

To assist you in finding reliable options, our team has meticulously curated a list of the best motorcycle loans specifically designed for individuals with bad credit.

This ensures you can secure the necessary financing without unnecessary hassles or concerns about authenticity.

Direct Lenders For Motorcycle Loan With Bad Credit In 2023

Overall Best Bad Credit Motorcycle Loan Lender, Editor's Choice

24-hour payment guaranteed

Loans for bad credit score

No hidden charges

$200 - $5,000

Loan Amount

Highly rated lender offering a streamlined approval process

Easy lending process

User-friendly interface

No hidden charges

$1,000 - $50,000

Loan Amount

Top Choice for Quick Motorcycle Loans

Simple Requirements

High loan amounts

No extra service fees

$1000-$35,000

Loan Amount

The Top Choice for Dependable Motorcycle Loans

Pros

- Loans for bad credit score

- Good customer protection policy

- No hidden charges

- Fast payouts

- Easy application

Cons

- You can only apply online

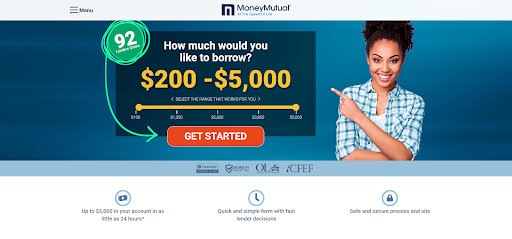

MoneyMutual is a renowned online lender in the US, specializing in providing loans to individuals with poor credit histories. Having over a decade of experience, they have established a strong reputation for connecting borrowers with suitable lenders.

By collaborating with reputable credit unions, MoneyMutual helps borrowers secure affordable loans with favorable monthly payment options but also assists in improving their credit scores.

Acting as a middleman, MoneyMutual simplifies the process of finding a reliable motorcycle loan lender, offering pre-approved loans for those with bad credit.

They also provide financial education tools and information to help borrowers manage their loans and achieve their financing goals. With a user-friendly interface and quick payouts, MoneyMutual is highly viewed by borrowers who value a stress-free loan application process.

Highlights

Efficient and Fast Application

Excellent Lender Network

Emergency Loans

Instant Loans

Secure Platform

Efficient and Fast Application

MoneyMutual has a fast and efficient loan application process. The brand has one of the least stressful processes for obtaining a motorcycle loan in the United States.

You can get money to help you obtain a used motorcycle or a new one. To get a loan, you must fill out the form on the brand’s website, and you will get underway.

The platform requests your age, name, residential address, annual earnings, bank account, and personal details to link you with the best lenders.

Excellent Lender Network

MoneyMutual is the best hub to get motorcycle loans. Once you obtain approval from the company, you can access many lenders.

You may need to input certain information on the lender site to complete your application process.

Furthermore, the brand has an interactive section that allows you to ask questions on the site while getting better loan offers. You can compare offers because the brand lets you choose from its vast lender network.

Emergency Loans

You can enjoy a loan of up to $5000 when you apply for a motorcycle loan with MoneyMutual. Additionally, you can access quick loans with excellent loan options to help you purchase your motorcycle.

Instant Loans

You can immediately obtain the money you need to purchase your motorcycle. MoneyMutual facilitates your payout within 24 hours after applying if you meet the application requirements

Secure Platform

MoneyMutual does not share your information with third-party groups. Instead, the brand protects your information and only shares the primary data lender networks need to process your loan.

Pros

- Reasonable loan amounts

- Excellent payment packages

- User-friendly interface

- Loan approval for bad credit

- No hidden charges

Cons

- Higher interest rates

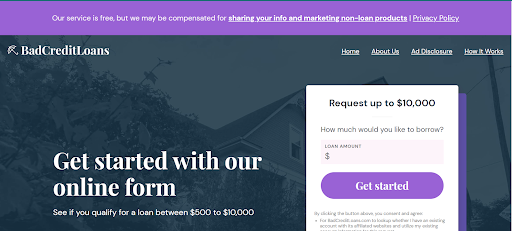

BadCreditLoans is another champion in the finance and lending industry. MoneyMutual has become a hero for individuals seeking motorcycle loans despite having bad credit scores.

One remarkable aspect of BadCreditLoans is their commitment to delivering the loan amount on the agreed-upon due date, regardless of the borrower’s purpose for obtaining the loan. Additionally, the BadCreditLoans has the fastest loans in reasonably short periods.

Like MoneyMutual, financial education tools are present on their website. These tools can increase your finance knowledge while generating a good credit score.

BadCreditLoans teaches you how to manage your finances after borrowing money. You also gain insight into the benefits of long and short-term loans.

You must be a Citizen of the United States before you can enjoy their lending services. Moreover, meeting the requirement of having a consistent income flow reflected in your bank account history is crucial for obtaining the loan.

Please fulfill this condition to avoid higher interest rates when seeking a lender.

Highlights

Fast Application

Excellent Loan Amounts

No Hidden Charges

Flexible Repayments

Guaranteed Approval

Fast Application

Bad Credit Loans have a usually quick application process that makes it easier to obtain your loans within a shorter period.

However, you must complete your online form to get a loan from the service. Additionally, you must pass the brand’s citizenship criteria by providing proof of citizenship. Once everything is in place, you can enjoy pre-approved loans from the brand.

Excellent Loan Amounts

BadCreditLoans offers some of the best loan amounts in the United States. They provide loans between $500 to $5000. Hence, you can use this brand’s pre-approved loans to obtain any motorcycle.

No Hidden Charges

You don’t have to pay for hidden charges and won’t find any origination fees, fees for late payments, and other hidden charges when using this platform.

Flexible Repayments

BadCreditLoans has flexible payment plans to help you enjoy your loan. You can enjoy this service if you are a low-income earner who needs financing for a used motorcycle. Furthermore, BadCreditLoans has different payment options you can consider to fulfill your financing needs.

Guaranteed Approval

Your credit score does not affect loan approval with Bad Credit Loans. BadCreditLoans is an excellent financing option if you need loans with guaranteed approval. You won’t need to stress about your finances because BadCreditLoans offers loans with flexible payment packages

#3. FundsJoy

Top Online Lender for Motorcycle Loans with Bad Credit

Pros

- Offer motorcycle loans

- Easy application

- Loan Calculator

- Guaranteed approvals

- Secure website

Cons

- Only accessible by U.S residents

FundsJoy provides loans for motorcycles without considering your credit history. They prioritize doing business with you daily without concern for your poor credit score. All you need to do is fill out an application form to access the best financing option for your motorcycle loan.

One unique aspect of FundsJoy is connecting borrowers with lenders in their network. They have many lenders available, ensuring you can find one for your loan needs.

FundsJoy even offers third-party lender services to assist with financing if you cannot secure a loan from direct lenders.

When using FundsJoy’s lending service, you won’t encounter inflated loan fees or altered conditions or rates. You can review the loan offers provided before committing to any lender.

The service allows you to accept or reject a loan offer if it doesn’t meet your preferences. Additionally, you’re not required to make a down payment to obtain a loan from lenders connected through this service.

Highlights

Save Money

Multiple Loan Offers

Build Your Credit

Save Money

You can save money with this service because you do not have to pay outrageous fees as interest. Furthermore, the brand has reasonable monthly payments that do not strain your finances

Multiple Loan Offers

You can enjoy various loan offers using this service. The brand allows you to compare offers from different lenders before picking your preferred lender. Hence, you will get a new or used motorcycle loan at the best rates.

Build Your Credit

The brand helps build your credibility while obtaining a personal loan from its lenders. After making payments, the brand sends your updated credit history to credit unions to help develop a good rating.

Pros

- High loan amounts

- Fast payday loans

- Flexible repayment plans

- No extra service fees

- Guaranteed personal loan approval

Cons

- Higher interest rates for individuals with bad credit

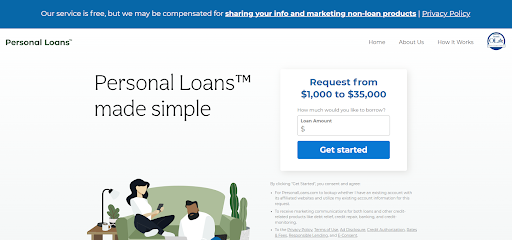

PersonalLoans offer an extensive range of resources and a vast network of lenders, making it easy for potential customers to secure loan approvals from online payday lenders.

Partnering with direct lenders and third-party financial institutions, Personal Loans specializes in providing licenses to individuals with bad credit scores.

Upon submitting your application, the brand swiftly evaluates the information provided and connects you with potential lenders. Meeting the brand’s requirements ensures a seamless approval process with various loan requests from online lenders.

You can compare loan terms and choose a lender that suits your needs. One notable advantage is the quick loan approval, often within hours.

PersonalLoans has received positive reviews, praised for its flexible loan packages, accessible information, and ability to cater to customers with bad credit.

The brand also assists in credit repair and building. Users appreciate the same-day loan offers with borrower-friendly terms and relaxed eligibility criteria regarding FICO credit scores.

Highlights

Highest Loan Amount

Requires Detailed Information

Not Application Hitches

72-month Repayment Schedule

Third-Party Lending Options

Highest Loan Amount

PersonalLonas can offer up to $35,000 with bad credit. PersonalLoans link you with lenders willing to give you loans directly.

Requires Detailed Information

PersonalLoans ask for detailed information from their customers before linking them with potential borrowers. However, the brand only asks for further details after you fill out the application form.

This ensures a streamlined application process where PersonalLoans takes all the necessary steps to complete your application.

Not Application Hitches

Unlike most online lending companies, you won’t face any hitches while applying for instant loans. Once you get approval, you should expect your loan within hours. You will be asked for a bank account to transfer funds.

72-month Repayment Schedule

Personal Loans have flexible repayment periods that go as long as 72 months.

Thus, you are only required to make minimal payments, ensuring your finances are not strained while still allowing you to save. You can always request a date change if the repayment date doesn’t favor you.

Third-Party Lending Options

PersonalLoans will connect you with third-party lenders if you need help to obtain loans from direct lenders. Hence, there is always a loan package waiting for you.

Pros

- Free service

- Quick service

- Easy payouts

- Loans for bad credit

- Flexible repayments

- No extra fees

- Guaranteed approval

Cons

- High annual percentage rate

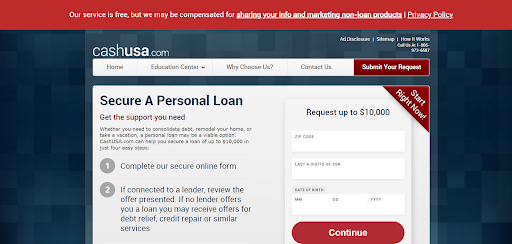

Many payday loan companies offer secure and unsecured personal loans, and many provide valuable educational content to help borrowers make informed financial decisions. CashUSA, in particular, excels in terms of value among the various options available.

CashUSA allows you to leverage their educational resources to learn about debt calculation and efficient credit score management, a rarity among credit loan companies. They prioritize helping you make the best loan decisions during the application process.

While CashUSA operates as a facilitator, connecting borrowers to potential lenders, they ensure approval is highly likely, even for individuals with bad credit scores.

The brand specializes in providing bad credit personal loans, streamlining the loan application process to be quick and user-friendly.

Additionally, CashUSA enables clients to monitor their credit, improve their credit scores, and rectify errors.

The uniqueness of CashUSA’s services is evidenced by its extensive customer base of over a million clients, a testament to their overall performance.

Customers appreciate the brand’s vast network of lenders and the inclusive approach that doesn’t discriminate against individuals with poor credit scores.

Flexibility in repayment plans further enhances the positive user experience, establishing CashUSA as a trusted online payday company

Highlights

Easy Interface

High Loan Amounts

Trusted Financial Institution

Detailed Information

Relaxed Eligibility Criteria

Guaranteed Information Safety

Flexible Repayment Schedule

Easy Interface

CashUSA has an easy-to-understand interface that quickens application processes. The brand features loans as high as $10,000 and pays no attention to credit scores while showcasing its loan packages.

High Loan Amounts

CashUSA is one of the few online loan services offering this much money to people with bad credit. Most brands will only do this if it is a good investment.

However, CashUSA believes in providing everyone an equal chance. Hence, the brand allows users financial freedom while they build their credit scores simultaneously.

Trusted Financial Institution

CashUSA is a well-known financial institution with an impeccable reputation and the most trusted financial institutions in the country. This financial institution educates you on how to manage your finances better.

However, you must provide detailed personal information before you can gain access to their loans. CashUSA also dives deep and asks questions about your credit history and permanent or rented home address.

Detailed Information

To proceed with their services, the brand requests that potential customers provide their social security number and a valid form of identification.

The process might be cumbersome and stressful compared to other companies, but not all companies will be as committed as CashUSA. In addition, you can go through the stress of providing information in the comfort of your home.

Relaxed Eligibility Criteria

CashUSA runs your data through its eligibility criteria after you submit your details. Once you scale through, the brand completes your application process.

CashUSA links its customers with reliable lenders and only connects you with potential lenders.

You still have to meet the eligibility criteria of these lenders. CashUSA connects you with several lenders, allowing you to compare loan offers.

Guaranteed Information Safety

One perk of using CashUSA is that your information remains with the company. Your information is encrypted and protected. No third-party organizations will have access to it. CashUSA doesn’t ask for extra money to offer services to its customers.

Flexible Repayment Schedule

CashUSA provides one of the best and most flexible repayment schedules. Unlike most vendors, you can have as many as 70 months to repay a loan.

The flexible repayment schedules also make it easy for low-income earners to enjoy loans. Low-income earners can leverage the repayment schedule so they won’t strain their resources.

How We Made This List For The Best Bad Credit Motorcycle Loans?

It would help if you thrashed out several things before getting a motorcycle loan. The first issue you will face when getting motorcycle loans is the brand to consider.

Before compiling our best motorcycle loans list, we considered various factors to pick the best brands.

We discovered that some lenders charged high-interest rates on any personal loan they offered to their clients. Thus, we decided to consider lending companies that offered low motorcycle loan rates in our review.

Our team found several genuine brands offering users secured loan payments. However, we also found it challenging to pick the best five since these companies were in their numbers.

Our team used specific criteria to pick out the bad credit motorcycle financing lenders with low-interest rates.

What We Looked For Motorcycle Loans With Bad Credit?

Our team considered several factors before picking out lousy credit motorcycle financing companies. Before picking our best brands, we considered the brand reputation, customer satisfaction, interest rates, loan amount, and other factors.

Here are the criteria we used to select our loan products.

Interest Rates

Client Satisfaction

Reputation

Interest Rates

Payment Duration

Credit Union Affiliations

Interest Rates

We considered the interest rates offered by each finance brand before compiling our list. Our team discovered that some brands had high-interest rates on their loan offers.

We did not include such brands. Instead, we considered motorcycle loan companies with lower interest rates.

Client Satisfaction

While conducting our research, we discovered that client satisfaction was integral to getting the best financial products for motorcycle loans.

The customer review section revealed clients’ satisfaction with the financial product they obtained from motorcycle lenders. We uncovered that customers preferred brands with lower annual percentage rates.

Reputation

Our team also considered the reputation of bad credit borrowers before selecting the products. We found that users felt more comfortable patronizing new or used motorcycle loan companies with good track records.

These brands had built a reputation with their clients over time. Thus, these clients trusted them to offer motorcycle loans with outstanding loan payments.

Interest Rates

We assessed the interest rate on each brand that offered motorcycle loans to its clients. While all brands offered these loans, some companies had competitive interest rates for new and old motorcycle loan purchases.

Hence we compared these interest rates to pick the best lenders on the market. We favored brands that provided higher loan amounts with lower APRs for a bad credit score. The brands on our list had the most competitive interest rates

Payment Duration

Each online lender has a payment duration for their loans. We considered brands with outstanding monthly payment structures. Also, brands that had a higher loan duration at lower interest rates.

Credit Union Affiliations

We considered brands with credit union affiliations. Such brands send your credit report to reputable credit unions to help you to build your credit score.

Thus, you could build your credit score if you continue using such brands to obtain loans with a poor credit history.

Over time, you could make a good credit report to help you get loans from a bank or other financial institutions that only give loans to people with good credit.

Buying Guide: Factors To Consider Before Choosing Bad Credit Motorcycle Loans

There are a few factors to consider when opting for bad credit loans from online payday loan services. As a potential borrower, your top priority is getting brands that offer the best interest rates.

You may sometimes find several bad credit loan apps willing to do business with you, but only some of these brands offer reasonable interest rates. It would help if you always considered specific criteria to get the best out of every deal.

We have compiled a guide to help you make the most out of bad credit loans. This comprehensive buying guide will assist you in looking for bad credit loans with guaranteed approval.

When hunting for bad credit loans, you should remember a few things.

While many lending companies offer loans for bad credit, it’s important to note that not all credit scores are treated equally. Loan requests must meet specific criteria set by lenders, which go beyond just bad credit scores.

Typically, a credit score of 620, the standard FICO outlines for lenders, is required by most bad credit loan companies—additionally, location, age, monthly income, job type, and existing debt influence loan eligibility.

A steady income significantly increases your chances of loan approval, as lenders prefer borrowers with a reliable source of income. However, individuals with low monthly payments may need help obtaining loans, and even if approved, the loan amounts may be limited.

Sometimes, lenders willing to work with you may impose high-interest rates, making the loan less favorable.

There are options to improve your loan prospects. One approach is to have someone with a higher credit score co-sign the loan agreement. Alternatively, ensuring that you meet the lender’s standards for a steady income can also increase your chances of loan approval.

The best way to choose which interest rates favor you is to compare each lender’s interest rate per offer. The interest rate per offer determines whether a loan will work for you. Let’s cast sentiments aside regarding bad credit loans.

A high loan amount sometimes means better interest rates. Learn how to calculate the interest rate per offer to understand payday loans better.

Some lenders will only offer fair interest rates for good credit loans. You will also notice that some lenders use the market’s index to determine interest rates. It would help if you considered any brands on our list to get the best interest rates.

Each brand on our list offers stable interest rates for its customers. Thus, you can choose any of these brands and obtain a loan.

Most users need to read the document’s contents before signing an agreement. It is always a wise choice to familiarize yourself with the terms and conditions of any contract before signing it. Hence, it would be best to hire a lawyer to check the terms and conditions of the agreement.

However, if you lack the resources, thoroughly reviewing the loan contract is essential to ensure no hidden charges or unfavorable terms.

Many bad credit loan companies impose unfair interest rates, so it is crucial to be vigilant and fully understand the terms and conditions before proceeding.

You could ask the lender for clarification in any contract section you need help understanding. It would aid in studying the repayment schedule to stay in line. Furthermore, you can also glance through the annual percentage rate and other vital factors.

Always protect your interest at all costs, as Some brands will only exploit you if you’re not careful. If you need more than a brand’s loan proposal, it’s best to avoid committing

Accepting bad credit loans goes beyond interest rates alone. It would help if you also considered the monthly repayment amount, don’t go for the plan if you can’t meet up.

No need to strain your finances if you can’t meet a specified program; you can always change it or the loan.

When considering the best repayment schedule, it is essential to always keep your monthly income in mind and ensure that your monthly payment aligns well with your overall financial situation.

The main point is to protect you and your finances from avoidable strain. You should only take out a loan if you can without any adverse effects.

Borrowing the needed amount at a particular time is also a good strategy. Don’t consider bad credit online companies loans if you don’t need the money. Always go for loan amounts you can conveniently pay back.

You can consider each lender’s repayment duration before picking out a loan. Using this tactic, you can get the best value for each lousy credit loan.

Not all lenders request extra charges for their services. The brands reflected on our list are reputable brands that don’t require any extra charge or service fee.

Hence, you can make your choice solely based on preference. However, if a lender adds additional service fees, you can always consider the amount charged by the companies.

Other brands go as far as hiding charges even after collecting service fees. You may be required to pay extra fees if you have little money in your bank account.

Some lenders charge customers for late or delayed payments. Other lenders may even charge you for bounced checks. To avoid complications, you should stick with the lenders on our list.

FAQs Related to Bad Credit Motorcycle Loans

Yes, getting a motorcycle loan with a poor credit score is possible. The brands on our list are renowned for having the best rates for short-term loans. Getting a bad credit motorcycle loan depends on your credit score.

Most brands will work with you if your credit score is above 620. You can improve your credit history to boost your loan chances.

You can fix your bad credit score, depending on your credit history. Improving your record could take a few months or even a year, but it is worth it. However, it may take years to repair your credit history if you are bankrupt.

Paying your loans on time is a great way to increase your credit score. Consistently repay your loans to build trust between you and the lenders.

Always request a date change if you need more time to meet with the loan payment. However, don’t take a loan if you can’t make a repayment.

Conclusion: Which Lender Is Ideal For Motorcycle Loans?

Online lenders willing to give out bad credit loans are easy to access. However, getting the best offers from reputable brands can pose an issue for newcomers and old-timers. Hence, we outlined and reviewed legitimate lenders you can obtain loans.

You will have access to loans at reasonable interest rates once you convince lenders of early repayments. Please take the time to prepare yourself before applying for a loan.

Studying loan proposals can save you from scams and pointless money losses.

Always look out for your interests when seeing a bad credit loan. If you’re not careful, you may end up in a bad situation that may be too rocky for your finances. Always try to ask lenders questions in areas you need help understanding.

Loan deals are severe if not properly handled, and you should always be mindful of your loan choices.